Driving Memphis &

Shelby County Forward

Economic Development

Growth Engine

EDGE brings together public and private entities to create new opportunities for economic advancement and prosperity.

Driving Memphis &

Shelby County Forward

Economic Development

Growth Engine

EDGE brings together public and private entities to create new opportunities for economic advancement and prosperity.

Driving Memphis &

Shelby County Forward

Economic Development

Growth Engine

EDGE brings together public and private entities to create new opportunities for economic advancement and prosperity.

– Program –

PILOT

A temporary, partial abatement of future real and/or personal property taxes that an applicant would otherwise have paid.

– Program –

TIF

Funds public infrastructure and improvements, and can finance private entities.

– Program –

ICED Loan

Small, forgivable loans that assist in facade and building improvements.

– Program –

IRB

Bonds that offer low-cost financing for manufacturing projects.

– Program –

FTZ

Allows companies importing parts/products to delay, reduce or eliminate taxes.

– Program –

FTZ

Allows companies importing parts/products to delay, reduce or eliminate taxes.

Key Industries of Memphis & Shelby County

EDGE By the Numbers

Economic Impact Since 2011

Created & Retained

Memphis/Shelby

County Jobs

MWBE Spend

with local MWBEs

More Than

In Capital Investment

Generated

In Tax Revenue

EDGE By the Numbers

Economic Impact Since 2011

Created & Retained

Memphis/Shelby

County Jobs

MWBE Spend

with local MWBEs

More Than

In Capital Investment

Generated

In Tax Revenue

Our Award-Winning Transparency

EDGE and its partners provide incentive, finance and small business development programs that help your business grow.

View Shelby County businesses that have received grants from EDGE Programs

EDGE Recognition for Excellence

Good Jobs First

2013: Tied for for transparency in incentive disclosures

Rebuild Tennessee

2014: Awarded for the EDGE Paul Lowery Road Project

SEDC

2014: Superior Award for EDGE Database and Merit Award for Regional Economic Development Website

CDFA

2018: Distinguished Development Finance Local Agency Award

Site Selection Magazine

2020: Mac Conway Awardfor Excellence in Economic Development

IEDC

2020: Excellence in Economic Development Gold Award for NEED Grant Program

Site Selection Magazine

2021: Mac Conway Awardfor Excellence in Economic Development

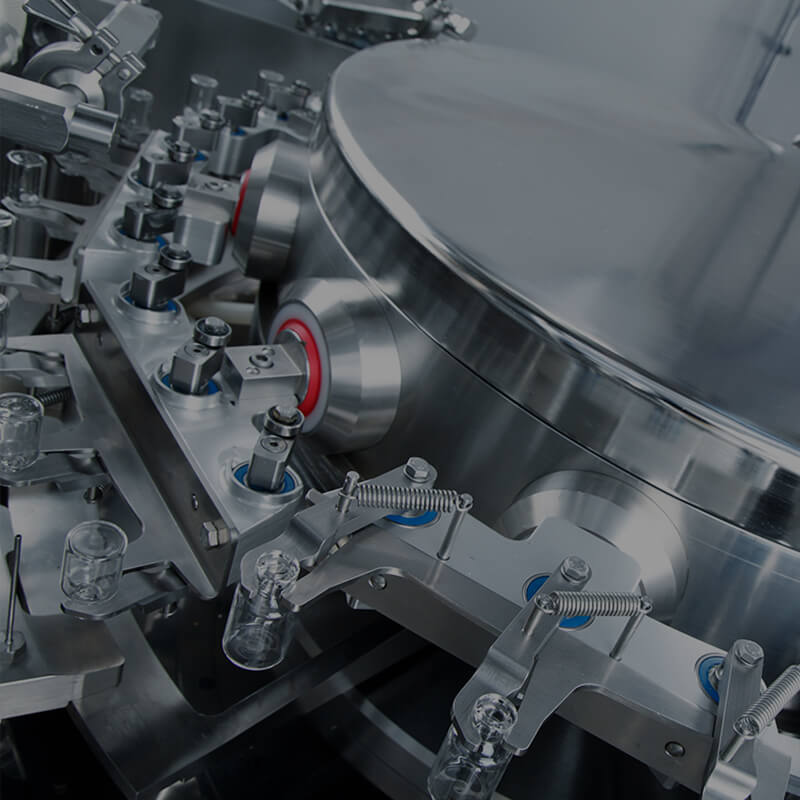

Jobs PILOT

Cognate BioServices Inc

Cognate BioServices, Inc. received approval for a 15-year Jobs PILOT encouraging the company to create 561 jobs paying an average wage of $63,749. The company plans to invest $213 million to renovate three Memphis industrial properties to house cell-therapy operations, contract development and manufacturing for drug sponsors, and related logistics. Founded in 2002, Baltimore-based Cognate BioServices is a leading contract developer and manufacturer of advanced cell and gene therapies. As the demand for regenerative medicine, cancer treatments and other live-cell biologics increases, Cognate is diversifying its services from clinical into commercial applications and now has facilities in the United States, United Kingdom, and Sweden.

Good Jobs First

2013: Tied for for transparency in incentive disclosures

Rebuild Tennessee

2014: Awarded for the EDGE Paul Lowery Road Project

SEDC

2014: Superior Award for EDGE Database and Merit Award for Regional Economic Development Website

CDFA

2018: Distinguished Development Finance Local Agency Award

Site Selection Magazine

2020: Mac Conway Awardfor Excellence in Economic Development

IEDC

2020: Excellence in Economic Development Gold Award for NEED Grant Program

Site Selection Magazine

2021: Mac Conway Awardfor Excellence in Economic Development

Jobs PILOT

Cognate BioServices Inc

Cognate BioServices, Inc. received approval for a 15-year Jobs PILOT encouraging the company to create 561 jobs paying an average wage of $63,749. The company plans to invest $213 million to renovate three Memphis industrial properties to house cell-therapy operations, contract development and manufacturing for drug sponsors, and related logistics. Founded in 2002, Baltimore-based Cognate BioServices is a leading contract developer and manufacturer of advanced cell and gene therapies. As the demand for regenerative medicine, cancer treatments and other live-cell biologics increases, Cognate is diversifying its services from clinical into commercial applications and now has facilities in the United States, United Kingdom, and Sweden.

Good Jobs First

2013: Tied for for transparency in incentive disclosures

Rebuild Tennessee

2014: Awarded for the EDGE Paul Lowery Road Project

SEDC

2014: Superior Award for EDGE Database and Merit Award for Regional Economic Development Website

CDFA

2018: Distinguished Development Finance Local Agency Award

Site Selection Magazine

2020: Mac Conway Awardfor Excellence in Economic Development

IEDC

2020: Excellence in Economic Development Gold Award for NEED Grant Program

Site Selection Magazine

2021: Mac Conway Awardfor Excellence in Economic Development

Jobs PILOT

Cognate BioServices Inc

Cognate BioServices, Inc. received approval for a 15-year Jobs PILOT encouraging the company to create 561 jobs paying an average wage of $63,749. The company plans to invest $213 million to renovate three Memphis industrial properties to house cell-therapy operations, contract development and manufacturing for drug sponsors, and related logistics. Founded in 2002, Baltimore-based Cognate BioServices is a leading contract developer and manufacturer of advanced cell and gene therapies. As the demand for regenerative medicine, cancer treatments and other live-cell biologics increases, Cognate is diversifying its services from clinical into commercial applications and now has facilities in the United States, United Kingdom, and Sweden.

Upcoming Meetings

Wednesday, April 17, 2024: EDGE Board Meeting

Wednesday, April 17, 2024

Location: Junior Achievement of Memphis and the Mid-South

Wednesday, May 15, 2024: EDGE Board Meeting

Wednesday, April 17, 2024

Location: Junior Achievement of Memphis and the Mid-South

Wednesday, June 19, 2024: EDGE Board Meeting

Wednesday, April 17, 2024

Location: Junior Achievement of Memphis and the Mid-South

Wednesday, July 17, 2024: EDGE Board Meeting

Wednesday, April 17, 2024

Location: Junior Achievement of Memphis and the Mid-South

Newsroom

EDGE Express Newsletter: April 2024

Click here to view the April 2024 edition of the EDGE Express newsletter.

EDGE Commits Funds to City Crime Prevention Program, Approves Two ICED Loans

At today’s EDGE Board meeting, funds to support small businesses that implement Crime Prevention Through Environmental Design (CPTED) were approved, following a request from the City of Memphis. The EDGE Board also met and approved two forgivable Inner City Economic...

Corky’s Food Manufacturing, LLC to Expand Manufacturing Operations in Shelby County

Tennessee Gov. Bill Lee, Department of Economic and Community Development Commissioner Stuart C. McWhorter and Corky’s Food Manufacturing, LLC officials announced today the company will expand manufacturing operations at its 3006 Fleetbrook Drive location in Memphis....